Bagader Trading

Tyres, tubes and batteries. Largest stockist of Chinese, Indian and Indonesian Tyres, Korean Tubes and Batteries and a leading exporter of tyres to Africa from Dubai...

Did you know that the flowers which were used during the inaugural of World Cup in Johannesburg came from the Ethiopian rose gardens of Sai Ramakrishna Karuturi. Karuturi, a Bangalore businessman who has been acquiring land in African nations, has already become the biggest rose grower in the world, and one of the world’s biggest private land owners. Interestingly, he also owns Karuturi Sports, a Kenyan football club (earlier called Sher Agencies) that plays in the country’s premier league.

What Karuturi started a few years ago has opened the floodgates for many Indian corporates. Several Indian companies have already leased land in Africa and many others too are eyeing opportunities in commercial agriculture in different countries in the continent. “In many cases, Indian companies that already have a presence in Africa are looking at getting involved in the agricultural sector, even if they are not intrinsically farming majors. There are companies, which are doing large infrastructure projects, that are offered land holdings usually on lease. To enter commercial agriculture, such companies will have to look for expertise within the farming community,” says Shipra Tripathi, director and head of CII Africa.

The Tata group has been

given a land lease in Uganda to run a pilot agricultural project, while the

Jaipurias of RJ Corp have a lease of a 50-acre model

dairy farm. The latter is already active in dairy products in African markets such

as Uganda and Kenya. Construction major Shapoorji

Pallonji & Co has acquired the lease for 50,000 hectares of land in Ethiopia and

may look at agricultural projects in

future. And it’s not just large Indian companies, small and medium enterprises in

sectors ranging from spices and tea to chemicals

are looking at entering the commercial agriculture space in Africa.

The Tata group has been

given a land lease in Uganda to run a pilot agricultural project, while the

Jaipurias of RJ Corp have a lease of a 50-acre model

dairy farm. The latter is already active in dairy products in African markets such

as Uganda and Kenya. Construction major Shapoorji

Pallonji & Co has acquired the lease for 50,000 hectares of land in Ethiopia and

may look at agricultural projects in

future. And it’s not just large Indian companies, small and medium enterprises in

sectors ranging from spices and tea to chemicals

are looking at entering the commercial agriculture space in Africa.

There are roughly about 70 Indian companies which are already in the process of making a foray into the farming sector in Africa. The countries which offer big opportunities include Ethiopia, Malawi, Kenya, Uganda, Liberia, Ghana, Congo and Rwanda. Various Indian tea companies, for instance, are making a beeline to acquire estates. BM Khaitan-owned McLeod Russel India, the largest integrated tea company in the world, has already taken the acquisition route with Uganda’s Rwenzori Tea Investments which it bought for $25 million.

The acquisition is being carried out through Borelli Tea Holdings of the UK, which is a wholly-owned subsidiary of McLeod Russel India. The Rwenzori Tea Investments has six estates within its fold and can produce 15 million kilogrammes of tea annually. Punjab-based farmers, who are known for feeding the Indian population, now want to try their hands offshore, with a group of progressive farmers all set to acquire 50,000 hectares of farm land on lease in Ethiopia for growing high-value cash crops, including pulses and maize.

“We will be inking a deal with the Ethiopia government for getting at least 50,000 hectares of area for growing crops like pulses and maize, which will be exported to India and Europe,” Confederation of Potato Seed Farmers President Sukhjit Singh Bhatti said. What encouraged these potato growers to try their hand at farming overseas was availability of fertile land at almost throwaway rates, duty free imports of capital goods and the zero duty on farm exports offered by Ethiopia.

The ambassadors of various African countries, including Tanzania

and Uganda,  also

visited Punjab recently and encouraged farmers from the state to till the land in

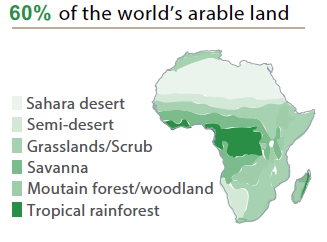

their countries. “Vast tracts of arable land are lying vacant. The land is fertile,

the climate is suitable and water is abundant. Also, both land and labour are

cheap,” says Punjabi farmer Jaswinder Singh. Punjabi farmers are scaling up their

small Indian farms into large African plantations in Ethiopia, Kenya, Madagascar,

Senegal and Mozambique. The profit opportunities are huge, with growers exporting

rice, wheat, sugar cane and lentils back to Indian and European markets. And it’s

not just individual farmers taking part – even large Indian agri-companies like

Karuturi Global (a rose producer) and Rana Sugars are moving to the area. From the

Indian perspective, it seems like an ideal situation.

also

visited Punjab recently and encouraged farmers from the state to till the land in

their countries. “Vast tracts of arable land are lying vacant. The land is fertile,

the climate is suitable and water is abundant. Also, both land and labour are

cheap,” says Punjabi farmer Jaswinder Singh. Punjabi farmers are scaling up their

small Indian farms into large African plantations in Ethiopia, Kenya, Madagascar,

Senegal and Mozambique. The profit opportunities are huge, with growers exporting

rice, wheat, sugar cane and lentils back to Indian and European markets. And it’s

not just individual farmers taking part – even large Indian agri-companies like

Karuturi Global (a rose producer) and Rana Sugars are moving to the area. From the

Indian perspective, it seems like an ideal situation.

Agriculture is the Africa’s most important economic sector – it still employs more than half the labour force yet remains one-fourth as productive as its counterparts around the world. One recent survey of this huge sector concluded that part of that productivity gap can be explained by the fact that nearly two-thirds of Africa's agricultural land has been degraded by erosion and misused pesticides.

In Ethiopia, 85 per cent of the land is damaged. Correcting this damage is therefore critically important – agriculture contributes at least 40 per cent of exports, 30 per cent of GDP, up to 30 per cent of foreign-exchange earnings, and 70 to 80 per cent of employment. Get it right, and the wider economic benefits could be huge – the UK-based Overseas Development Institute points out that of the 30 fastest growing agricultural economies, 17 are in Sub Sharan Africa.

Little

wonder then that overseas investors have started to take notice. CRU, a small fund

management firm, recently launched a Malawi-based fund

called Africa Invest. The retail-orientated fund can be accessed for as little as

£4,000. The fund has made an initial investment of £2

million in 2,000 hectares of land that's producing paprika for western supermarkets.

With land prices starting at £800 per hectare it's

relatively easy to amass large farms that can be upgraded with new technology,

mechanisation and better production methods. Annual

returns on capital are expected to exceed 30 to 40 per cent.

Little

wonder then that overseas investors have started to take notice. CRU, a small fund

management firm, recently launched a Malawi-based fund

called Africa Invest. The retail-orientated fund can be accessed for as little as

£4,000. The fund has made an initial investment of £2

million in 2,000 hectares of land that's producing paprika for western supermarkets.

With land prices starting at £800 per hectare it's

relatively easy to amass large farms that can be upgraded with new technology,

mechanisation and better production methods. Annual

returns on capital are expected to exceed 30 to 40 per cent.

A much larger version of this scheme is being marketed by hedge fund Emergent. It's targeting a total return of 400 per cent over the next five years, partly due to the phenomenal rising land values, investment in better technology to improve productivity and the introduction of a new form of farming called no till agriculture.

To demonstrate the potential, it's been running a trial 7,200 acre project over the last three years that's showed an average 33 per cent annual gain in output from soft agricultural products and a total return of 120 per cent. The company points out that the return was based on much lower historic soft commodities prices, which have nearly doubled in recent years. This fund believes that returns on equity for maize should be 35 per cent a year, and 25 per cent for soybeans.

Emergent isn't the only player in the agricultural space – palm oil companies are very active in West Africa and Lonhro has also spotted the potential to provide capital, technology and know-how to Africa's farming sector. “More and more, the world will look to Africa to be its breadbasket, and I hope that when the world looks… it is Africans and African farmers who will profit from becoming the world’s breadbasket,” said Hillary Clinton during her recent visit to Africa.

Tyres, tubes and batteries. Largest stockist of Chinese, Indian and Indonesian Tyres, Korean Tubes and Batteries and a leading exporter of tyres to Africa from Dubai...

Complete range of automobile spare parts, tyres, batteries and lubricants available for the tough, demanding driving conditions of Africa. A-MAP is one of the leading exporters of automobile spare...

Made in Korea under strict quality control, Sebang Batteries are gaining popularity in the African markets as they are durable, rugged and competitively priced. Available in various sizes...

Exedy Middle East FZCO manufactures a complete range of clutch and transmission solutions for a wide range of automobiles and machinery. Exedy clutches are in high demand in Africa...

Gifts, Novelties and Promotional Material supplier. Watches, Bags, Key Chains, Desktop accessories, Pen Sets, Gift Items... Wanted business partners in Africa...

Competitively priced tyres of almost all well known brands like Advance, Double Happiness, GT, Double Ox, Hankook etc. BBG Trading is a major exporter to African markets...

Manufacturer of high quality range of cosmetics – including haircare, skincare, nail care products. The company seeks buyers of cosmetics in Africa. Agents and distributors wanted in African...

An established export and distribution company based out of Hong Kong and China since 1990. The company specializes in the trade of dry-break bulk agro-commodities...

An established export and distribution company based out of Hong Kong and China since 1990. The company specializes in the trade of dry-break bulk agro-commodities...